The latest news about the recent African Activity from April 2021

Editor's Summary - Peter Elliott

The industry saw a slight pick-up in exploration drilling in April, with 5 exploration wells offshore in Egypt, Angola and Gabon, and 10 onshore the Western Desert Egypt, and an exciting play-opener in the Kavango basin in Namibia. Development work has restarted in Gabon and Congo for Assala, M&P and Perenco.

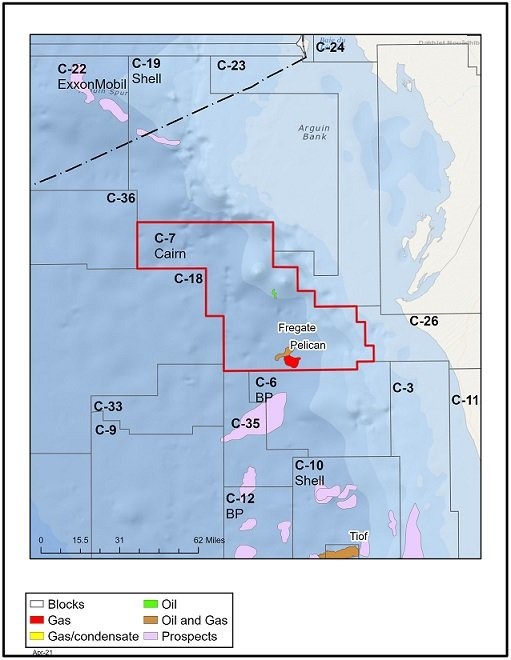

Deal flow remains focused mainly on developing and producing assets across the continent. Carlyle-backed Boru Energy is in talks with Occidental Petroleum to buy its share of Jubilee and TEN in Ghana. Woodside appear to have finalised a deal to buy FAR out of Sangomar in Senegal, leaving just Woodside and Petrosen on the field development. Cairn have taken Block C-7 offshore Mauritania. Rumours suggest Shell will farm-in with Impact on the Area 2 Block in South Africa. Panoro have closed their deal with Tullow in Equatorial Guinea. A couple of deals have failed to close this month; Sonatrach in Algeria have foreclosed on the Ain Tsila gas field from Sunny Hill Energy, ex Petro Celtic. Dana Gas walked away from their deal with IPR to sell their 14 development leases in Egypt. Major news from onshore East Africa, usually a vacuum of E&P activity these days; CNOOC and Total have finally agreed with each other and the governments of Tanzania and Uganda to reach FID for the Tilenga and Kingfisher developments and the associated East Africa Crude Oil Pipeline. Kingfisher was drilled back in 2006.

Angola is launching its bid round for onshore blocks, and interestingly Sonangol will sell part of its interest in 8 concessions, 4 of which have production.

Deal flow remains focused mainly on developing and producing assets across the continent. Carlyle-backed Boru Energy is in talks with Occidental Petroleum to buy its share of Jubilee and TEN in Ghana. Woodside appear to have finalised a deal to buy FAR out of Sangomar in Senegal, leaving just Woodside and Petrosen on the field development. Cairn have taken Block C-7 offshore Mauritania. Rumours suggest Shell will farm-in with Impact on the Area 2 Block in South Africa. Panoro have closed their deal with Tullow in Equatorial Guinea. A couple of deals have failed to close this month; Sonatrach in Algeria have foreclosed on the Ain Tsila gas field from Sunny Hill Energy, ex Petro Celtic. Dana Gas walked away from their deal with IPR to sell their 14 development leases in Egypt. Major news from onshore East Africa, usually a vacuum of E&P activity these days; CNOOC and Total have finally agreed with each other and the governments of Tanzania and Uganda to reach FID for the Tilenga and Kingfisher developments and the associated East Africa Crude Oil Pipeline. Kingfisher was drilled back in 2006.

Angola is launching its bid round for onshore blocks, and interestingly Sonangol will sell part of its interest in 8 concessions, 4 of which have production.

April Monthly Highlights

Exploration Drilling

- Angola: In block 15/06, Eni has discovered oil at the Cuica-1 well. The well is the first of a 3-well exploration campaign and it has mobilised the Sonangol Libongos drillship to the NW corner of the block to the next drill site.

- Egypt: Dapetco has discovered oil with the SWA 10-1X well and are drilling the SWA 1-4X well in the South West Alamein license. Petrosalam is still drilling a sidetrack on NWO-5 on the Northwest October oil field in the Gulf of Suez. Oil shows and high gas readings have been detected.

- South Africa: Total said it has postponed any additional drilling in block 11B/12B along trend from Brulpadda and Luiperd. The firm is thought to be seeking improved gas development terms from the government of RSA.

Appraisal / Development

- Gabon: Maurel et Prom is to return to its development drilling campaign in the Ezanga permit onshore, in the second half of 2021. Q1 21 M&P’s working interest oil production (80%) on the Ezanga permit was 15,120 bopd (gross production: 18,901 bopd). Production from the field was limited to 19,000 bopd (or 15,200 bopd net to M&P’s working interest) due to production cuts imposed under OPEC quotas.

- Morocco: SDX has 4 development/appraisal wells planned for 2021 together on Lalla Mimouna and KSR, with plans also to test the Top Nappe Play.

- Uganda: Almost 15 years after drilling started on the Kingfisher trend, Total announced final agreements to reach FID on the Tilenga (Total) and Kingfisher (CNOOC) development and associated EACOP to Tanzania.

Deals

- Algeria: Sonatrach has terminated the contractual interest held by Sunny Hill Energy in the Ain Tsila project, thought to be worth over US$1 billion.

- Mauritania: Cairn have taken Block C-7. Cairn have worked on the block previously as partner with Total.

- Namibia: In the deepwater Orange Basin, Qatar Petroleum has entered into an agreement with Shell to take 45% in PEL 39 (2913A & 2914B). Shell has a number of drill-ready prospects on the block, including the Upper Cretaceous Graff prospect and the Lower Cretaceous carbonate Cullinan prospect.

Licencing Rounds

- Kenya: Ion Geophysical has been award an exclusive agreement for 3D multi-client surveys offshore the Lamu Basin ahead of a major bid round offering in the country in 2022.

New Ventures

- Egypt: Dana Gas says it has terminated its agreement for the sale of its Egyptian assets to IPR. The company has 14 development leases in Egypt, as well as Block 6 exploration block offshore, which was not part of the deal. Dana gas may continue to find a buyer for these producing assets. Also, Pharos continues to look for a buyer for their El Fayoum field complex.