Equatorial Guinea is a well-established oil and gas producer in West Africa. It hosts the Punta Europa gas complex, home to EG LNG, methanol manufacturing and power generation. However, most fields are mature and in decline. Can the country fully realize its gas potential? And will some companies choose to exit? This could create opportunities for others. We address some of the key themes in this report.

Our Equatorial Guinea offering covers six assets with full valuation models and reports, a comprehensive mapping function and portfolio analytics. Since the launch of our Ghana platform in late-2020, we have added coverage of 10 further countries across Sub-Saharan Africa including Angola, Nigeria, Cameroon and South Africa. We continue to work towards full coverage of the region, anticipating the addition of Congo, Gabon and Mozambique by mid-year.

1. Will exiting Majors provide M&A opportunities?

ExxonMobil and Chevron hold producing assets in Equatorial Guinea (EG), but we view the country as non-core to both. ExxonMobil has already stated its intention to leave, and Chevron inherited its position through the 2020 acquisition of Noble Energy, a deal driven by the independent’s US assets and offshore gas in Israel.

EG would prefer ExxonMobil and Chevron stay active, but other companies are better fits for aging assets – the planned investment at Ceiba/Okume (see next section) is a prime example of how the right companies can breathe new life into a mature project. As the Majors divest more and more mature assets in the region, this creates a buyer’s market.

Incumbent players: The obvious buyers of a mature oil asset are Trident Energy and Vaalco, both companies with proven redevelopment capabilities. Another E&P already present is Lukoil, which is looking for expansion opportunities across the region. However, it has no experience operating offshore West Africa.

New entrants: One possibility is mature field specialist EnQuest, which has extensive experience in decommissioning in the UK North Sea and Malaysia. While not currently present in EG, the company would be a strong operational fit. Other potentially interested parties are Africa Oil and Carlyle-backed Assala Energy, both of whom have a strong regional presence.

The partnership combines Trident’s mid-life optimization skillset with Kosmos’ exploration/subsurface expertise to create value through redevelopment and near-field exploration. Panoro’s purchase of Tullow’s stake in early-2021 leaves a consortium fully aligned on investing in short-cycle opportunities.

Brownfield redevelopment: An immediate program of infill drilling, well reactivations, and the installation of downhole ESPs provided a 20%+ boost to production in 2017. Next up is an infill drilling and workover program over 2021/2022 at the Elon and Oveng fields in the Okume Complex.

Licence extensions: The partners initially want to align the expiry of both licences to 2034, but the real prize is an extension to 2050, enabling full exploitation – Panoro estimates this can unlock 179 MMbbl.

ILX upside: Kosmos made the Asam discovery (50-100 MMbbl) in 2019, which lies within the catchment area of the Ceiba FPSO. New exploration work is planned for 2022, targeting subsalt, structural plays beneath and adjacent to Ceiba/Okume.

In EG, we believe Zafiro has the potential to benefit from a similar redevelopment strategy. Further afield, the entry of Maurel and Prom to Angola’s Block 3/05 has breathed new life into a very mature asset and Canadian Natural Resources continues to develop phases and tie-backs on the Baobab project in Côte d’Ivoire..PNG)

There are stranded gas resources in the country that could be developed. And EG has long held ambitions to become a regional hub that processes gas from neighbouring Nigeria and Cameroon. In May last year, the government awarded a contract for a gas master plan study to realize the vision. However, there are obstacles.

Thank you to our partners Welligence for supply this article. Read more about them here.

1. Will exiting Majors provide M&A opportunities?

ExxonMobil and Chevron hold producing assets in Equatorial Guinea (EG), but we view the country as non-core to both. ExxonMobil has already stated its intention to leave, and Chevron inherited its position through the 2020 acquisition of Noble Energy, a deal driven by the independent’s US assets and offshore gas in Israel.

EG would prefer ExxonMobil and Chevron stay active, but other companies are better fits for aging assets – the planned investment at Ceiba/Okume (see next section) is a prime example of how the right companies can breathe new life into a mature project. As the Majors divest more and more mature assets in the region, this creates a buyer’s market.

Competing for attention – acquisition opportunities across West Africa

ExxonMobil

As part of its US$25 billion divestment target by 2025, ExxonMobil wants to sell its 71% operated stake in the mature Zafiro oil field. With over 100 producing wells, there is ample scope for well optimization and re-activation, and there is gas resource that could be developed. The current contract expires in 2025, but the government has shown willingness to extend licenses. We believe the following companies are possible buyers:Incumbent players: The obvious buyers of a mature oil asset are Trident Energy and Vaalco, both companies with proven redevelopment capabilities. Another E&P already present is Lukoil, which is looking for expansion opportunities across the region. However, it has no experience operating offshore West Africa.

New entrants: One possibility is mature field specialist EnQuest, which has extensive experience in decommissioning in the UK North Sea and Malaysia. While not currently present in EG, the company would be a strong operational fit. Other potentially interested parties are Africa Oil and Carlyle-backed Assala Energy, both of whom have a strong regional presence.

Chevron

We don’t consider EG a priority for Chevron. The assets lack materiality, and the portfolio is overwhelmingly gassy. A possible buyer is Marathon Oil, which operates the Alba field, the key gas supplier in the country. While EG is an outlier for the US independent, which has a portfolio heavily weighted to the onshore US, it is a valuable cash flow generator and provides diversification. Although Marathon may not be so keen on the idea of taking a near 100% stake in Alba and the maturing Aseng oil field, the Chevron portfolio would give it a 45% operating stake in Alen.2. Putting assets in the right hands – the Ceiba/Okume redevelopment

The right owners can rejuvenate mature assets, with Trident Energy’s Ceiba/Okume project a prime example. These oil assets were receiving little attention under former operator Hess, which was pivoting to its world-class Stabroek project in Guyana. Trident, along with Kosmos Energy, acquired the position in 2017.The partnership combines Trident’s mid-life optimization skillset with Kosmos’ exploration/subsurface expertise to create value through redevelopment and near-field exploration. Panoro’s purchase of Tullow’s stake in early-2021 leaves a consortium fully aligned on investing in short-cycle opportunities.

Brownfield redevelopment: An immediate program of infill drilling, well reactivations, and the installation of downhole ESPs provided a 20%+ boost to production in 2017. Next up is an infill drilling and workover program over 2021/2022 at the Elon and Oveng fields in the Okume Complex.

Licence extensions: The partners initially want to align the expiry of both licences to 2034, but the real prize is an extension to 2050, enabling full exploitation – Panoro estimates this can unlock 179 MMbbl.

ILX upside: Kosmos made the Asam discovery (50-100 MMbbl) in 2019, which lies within the catchment area of the Ceiba FPSO. New exploration work is planned for 2022, targeting subsalt, structural plays beneath and adjacent to Ceiba/Okume.

In EG, we believe Zafiro has the potential to benefit from a similar redevelopment strategy. Further afield, the entry of Maurel and Prom to Angola’s Block 3/05 has breathed new life into a very mature asset and Canadian Natural Resources continues to develop phases and tie-backs on the Baobab project in Côte d’Ivoire.

Ceiba/Okume redevelopment

3. Can Equatorial Guinea fully realize its gas potential?

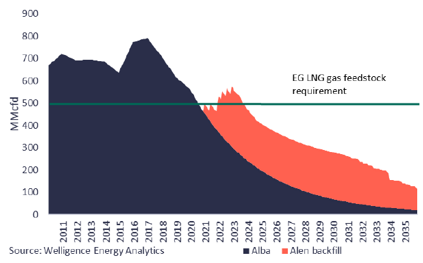

EG has a well-developed gas market, producing LNG, methanol and generating power at the Punta Europa complex on Bioko island. However, domestic supply is falling as the key producing asset, Marathon Oil’s Alba, is now in long-term decline. And while Chevron’s Alen development began deliveries to EG LNG in February 2021, no other domestic projects are progressing.There are stranded gas resources in the country that could be developed. And EG has long held ambitions to become a regional hub that processes gas from neighbouring Nigeria and Cameroon. In May last year, the government awarded a contract for a gas master plan study to realize the vision. However, there are obstacles.

- Neighbourhood politics: Reaching an agreement with Nigeria and Cameroon to monetize their gas through EG will be tough, even if it makes sense to do so. Nigeria is facing supply pressures for its own NLNG project and domestic market, while Cameroon is focused on developing its own opportunities, including FLNG. Domestic priorities will come first.

- Chevron’s future in EG: The US Major is a key gas supplier, following its 2020 Noble Energy acquisition. It’s a partner in Alba, and operates Alen, which started supplying EG LNG in February 2021. There are satellite development opportunities, including Diega, Carmen and Yoyo Yolanda (a cross-border field with Cameroon). However, EG was not central to the Noble deal and we think will struggle to compete for investment within Chevron’s portfolio.

- Fortuna development: The Lukoil-operated block holds almost 4 tcf of gas. A US$2 billion FLNG solution was mooted under previous operator Ophir, but the company failed to secure financing. Piping the gas to EG LNG may be considered as an option, but the 120 km distance to shore makes for challenging project economics.

Domestic gas supply outlook

Thank you to our partners Welligence for supply this article. Read more about them here.