Brownfield investment opportunities are emerging in Nigeria as international oil companies accelerate their energy transition strategies and divest non-core assets

Simon Anderson, Director of Consulting, Sub-Saharan Africa

.png)

Nigeria is Africa’s largest oil producer with an established oil and gas industry that dates back to the 1950s. In 2020, the country produced a daily average of 1.9 million barrels of oil and 4.6 billion cubic feet (bcf) of sales gas from over 220 fields and 160 operators, with over 260 companies with upstream interests.

There are five international oil companies (IOCs) present in Nigeria – Chevron, Eni, ExxonMobil, Shell and TotalEnergies. Collectively, they have equity participation in over 110 oil mining licenses (OMLs) and are responsible for 45% of Nigeria’s oil production and 40% of sales gas. Moreover, they hold 69% and 74% of the remaining commercial oil and gas reserves, respectively.

However, Nigeria’s upstream landscape is changing – and that could create opportunities for investors seeking brownfield assets with growth potential.

The IOCs are spending less in Nigeria

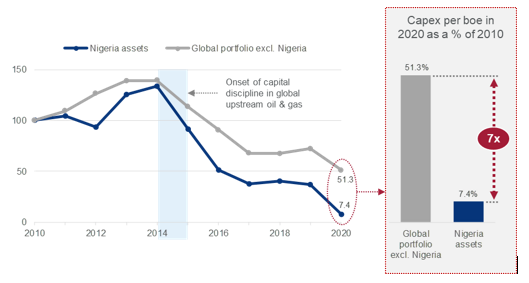

Following many years of growth in capital spending, the global upstream industry was forced to implement capital discipline measures following the 2014-15 oil price crash. Absolute spend decreased under the pretext of better discipline; relative spend, on a per barrel basis, fell as operators realised efficiency gains. However, the significant drop in investment in Nigeria goes beyond capital discipline alone.

The chart below shows the IOCs’ average capex per barrel of oil equivalent (boe) in Nigeria compared to that of their global upstream portfolio (excluding Nigeria) from 2010 to 2020 . In both cases, capex per boe decreased following the highs of 2014. In 2020 the average capex per boe across the global portfolios was 51% of 2010 levels, whereas the equivalent metric for the Nigeria assets was 7.4%. In other words, over the last decade the IOCs’ average capex per boe has fallen seven-times more in Nigeria compared to that of the rest of their portfolio.

IOCs are spending less on their Nigerian upstream assets

IOCs’ average capex per boe in Nigeria vs. their global upstream portfolio excluding Nigeria, 2010-20 (rebased, 2010 = 100)

Source: Wood Mackenzie

The IOCs are accelerating their energy transition strategies

Despite the profitability of their Nigerian assets, the IOCs are under increased shareholder pressure to accelerate their energy transition strategies. They’re reshaping their global portfolios towards lower emissions intensity operations and divesting non-core assets.

The chart below shows the IOCs’ average upstream emissions intensity in Nigeria compared to that of their global portfolio (excluding Nigeria) in 2020. For the three EuroMajors (Eni, Shell and TotalEnergies) the average emission intensity of their Nigeria assets is significantly higher than that of the rest of their portfolios. Divesting Nigerian assets is therefore one lever to reducing the emissions intensity of the overall portfolio.

IOCs are under pressure to reshape portfolios towards lower emission assets

IOCs’ average upstream emissions intensity in Nigeria vs. their global portfolio excluding Nigeria, 2020 (tCO2e/kboe)

.PNG)

Source: Wood Mackenzie

Opportunities for upstream investors in Nigeria?

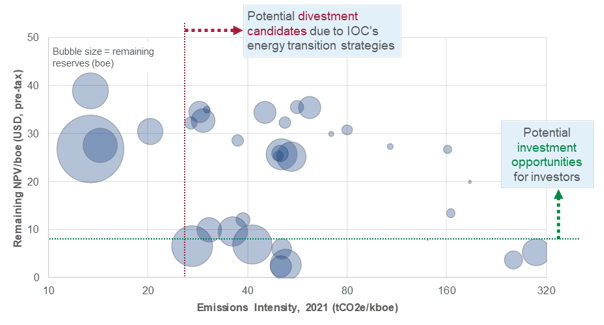

The energy transition is pushing the IOCs to divest Nigerian assets despite positive project economics. We have mapped their assets against two dimensions: potential divestment candidates (driven by energy transition objectives) and potential investment candidates (driven by project economics).

The chart below shows a scatter plot of the remaining net present value (NPV) per boe (at 10% discount rate) versus the emissions intensity for 35 IOC assets in Nigeria. Assets with high emissions intensity will be under pressure for divestment – the vertical red line represents the IOCs’ global average emissions intensity. Assets with sufficiently positive remaining value will present attractive opportunities for potential investors – the horizontal green line represents the minimum remaining value that beats 80% of Sub-Saharan Africa projects.

A large number of assets sit in the sweet spot of potential divestment candidates and attractive investment opportunities.

Many Nigerian upstream assets are potential candidates for divestment

Remaining NPV per boe vs. emissions intensity for 35 IOC assets in Nigeria, 2021 (bubble size relates to remaining reserves)

Source: Wood Mackenzie

In addition to the divestment drivers from the IOCs, there are several reasons why investors are increasingly interested in upstream opportunities in Nigeria:

Business Intelligence Partner

.png)

Nigeria is Africa’s largest oil producer with an established oil and gas industry that dates back to the 1950s. In 2020, the country produced a daily average of 1.9 million barrels of oil and 4.6 billion cubic feet (bcf) of sales gas from over 220 fields and 160 operators, with over 260 companies with upstream interests.

There are five international oil companies (IOCs) present in Nigeria – Chevron, Eni, ExxonMobil, Shell and TotalEnergies. Collectively, they have equity participation in over 110 oil mining licenses (OMLs) and are responsible for 45% of Nigeria’s oil production and 40% of sales gas. Moreover, they hold 69% and 74% of the remaining commercial oil and gas reserves, respectively.

However, Nigeria’s upstream landscape is changing – and that could create opportunities for investors seeking brownfield assets with growth potential.

The IOCs are spending less in Nigeria

Following many years of growth in capital spending, the global upstream industry was forced to implement capital discipline measures following the 2014-15 oil price crash. Absolute spend decreased under the pretext of better discipline; relative spend, on a per barrel basis, fell as operators realised efficiency gains. However, the significant drop in investment in Nigeria goes beyond capital discipline alone.

The chart below shows the IOCs’ average capex per barrel of oil equivalent (boe) in Nigeria compared to that of their global upstream portfolio (excluding Nigeria) from 2010 to 2020 . In both cases, capex per boe decreased following the highs of 2014. In 2020 the average capex per boe across the global portfolios was 51% of 2010 levels, whereas the equivalent metric for the Nigeria assets was 7.4%. In other words, over the last decade the IOCs’ average capex per boe has fallen seven-times more in Nigeria compared to that of the rest of their portfolio.

IOCs are spending less on their Nigerian upstream assets

IOCs’ average capex per boe in Nigeria vs. their global upstream portfolio excluding Nigeria, 2010-20 (rebased, 2010 = 100)

Source: Wood Mackenzie

The IOCs are accelerating their energy transition strategies

Despite the profitability of their Nigerian assets, the IOCs are under increased shareholder pressure to accelerate their energy transition strategies. They’re reshaping their global portfolios towards lower emissions intensity operations and divesting non-core assets.

The chart below shows the IOCs’ average upstream emissions intensity in Nigeria compared to that of their global portfolio (excluding Nigeria) in 2020. For the three EuroMajors (Eni, Shell and TotalEnergies) the average emission intensity of their Nigeria assets is significantly higher than that of the rest of their portfolios. Divesting Nigerian assets is therefore one lever to reducing the emissions intensity of the overall portfolio.

IOCs are under pressure to reshape portfolios towards lower emission assets

IOCs’ average upstream emissions intensity in Nigeria vs. their global portfolio excluding Nigeria, 2020 (tCO2e/kboe)

Source: Wood Mackenzie

Opportunities for upstream investors in Nigeria?

The energy transition is pushing the IOCs to divest Nigerian assets despite positive project economics. We have mapped their assets against two dimensions: potential divestment candidates (driven by energy transition objectives) and potential investment candidates (driven by project economics).

The chart below shows a scatter plot of the remaining net present value (NPV) per boe (at 10% discount rate) versus the emissions intensity for 35 IOC assets in Nigeria. Assets with high emissions intensity will be under pressure for divestment – the vertical red line represents the IOCs’ global average emissions intensity. Assets with sufficiently positive remaining value will present attractive opportunities for potential investors – the horizontal green line represents the minimum remaining value that beats 80% of Sub-Saharan Africa projects.

A large number of assets sit in the sweet spot of potential divestment candidates and attractive investment opportunities.

Many Nigerian upstream assets are potential candidates for divestment

Remaining NPV per boe vs. emissions intensity for 35 IOC assets in Nigeria, 2021 (bubble size relates to remaining reserves)

Source: Wood Mackenzie

In addition to the divestment drivers from the IOCs, there are several reasons why investors are increasingly interested in upstream opportunities in Nigeria:

- Project economics. Recent increases in oil prices and better capital discipline have significantly improved project returns, with further potential upside post-Petroleum Industry Act (PIA).

- Brownfield economics. Investment returns are typically better, with shorter payback periods, in brownfield projects compared to greenfield developments.

- World-class resources. Nigeria has 9.1 billion barrels (bnbbls) remaining oil reserves (of which 87% is onstream) plus 17.2 bnbbls of contingent resources (66% onstream).

- Gas. Nigeria has largely untapped gas potential, with over 175 trillion cubic feet (tcf)of remaining resources.

- Existing infrastructure. Nigeria has a large, established oil and gas industry that dates back to the 1950s.

Contact us to find out more about what is driving investor interest and how Wood Mackenzie – as the leading transactions advisor in the energy industry – can support your organisation.